This has been one of the biggest lessons of my entrepreneurial journey. This is the story of a hard lesson learned after rewarding an early employee with shares, giving access to company finances. A simple act of trust led to forged cheques, unauthorized property purchases, and significant tax penalties that nearly collapsed the company I painstakingly built over 15 years.

I've often hesitated to share this because of the legal process that has been continuously delayed since 2020; with no end in sight. Legal no action taken despite 3 reports since 2019. I’m lost, exhausted, frustrated, and financially tired, with no real outlet to share my true story. That's why I need to speak up now, at least, hopefully able to help others avoid falling into the same trap—just as I wish I had come across a story like this when I first started my business.

Prelude

Everything you need to know on how a simple trust cost me over RM1,000,000 in losses

My name is Tan, and I run a technology agency in Malaysia. This might be the hardest story to share, but it’s important to show how easily betrayal can come from those closest to you—and how its effects can ripple far into the future. I’m not here to assign blame, seek sympathy, or risk contempt of court. This is simply what has happened to me in Malaysia.

Over the years, I’ve been told not to speak out — because it could be seen as "Contempt of Court" or that "you can't fight with a DATUK father-in-law" or "What’s the point pursuing when you won’t get any cents back?". But staying silent doesn’t help anyone.

Despite everything, our company not only survived but continued to grow, even as the pandemic hit hard and we faced the added burden of fraudsters stealing funds. In fact, one of the best years ever. Initially, I feared this story could damage our reputation, and while I may never recover the money (you’ll understand why later), it’s time to share my story because fraudsters walk freely in Malaysia, and awareness is our best defense. Fraudsters thrive on exploiting trust and avoiding accountability, counting on the silence of victims to prey on the next.

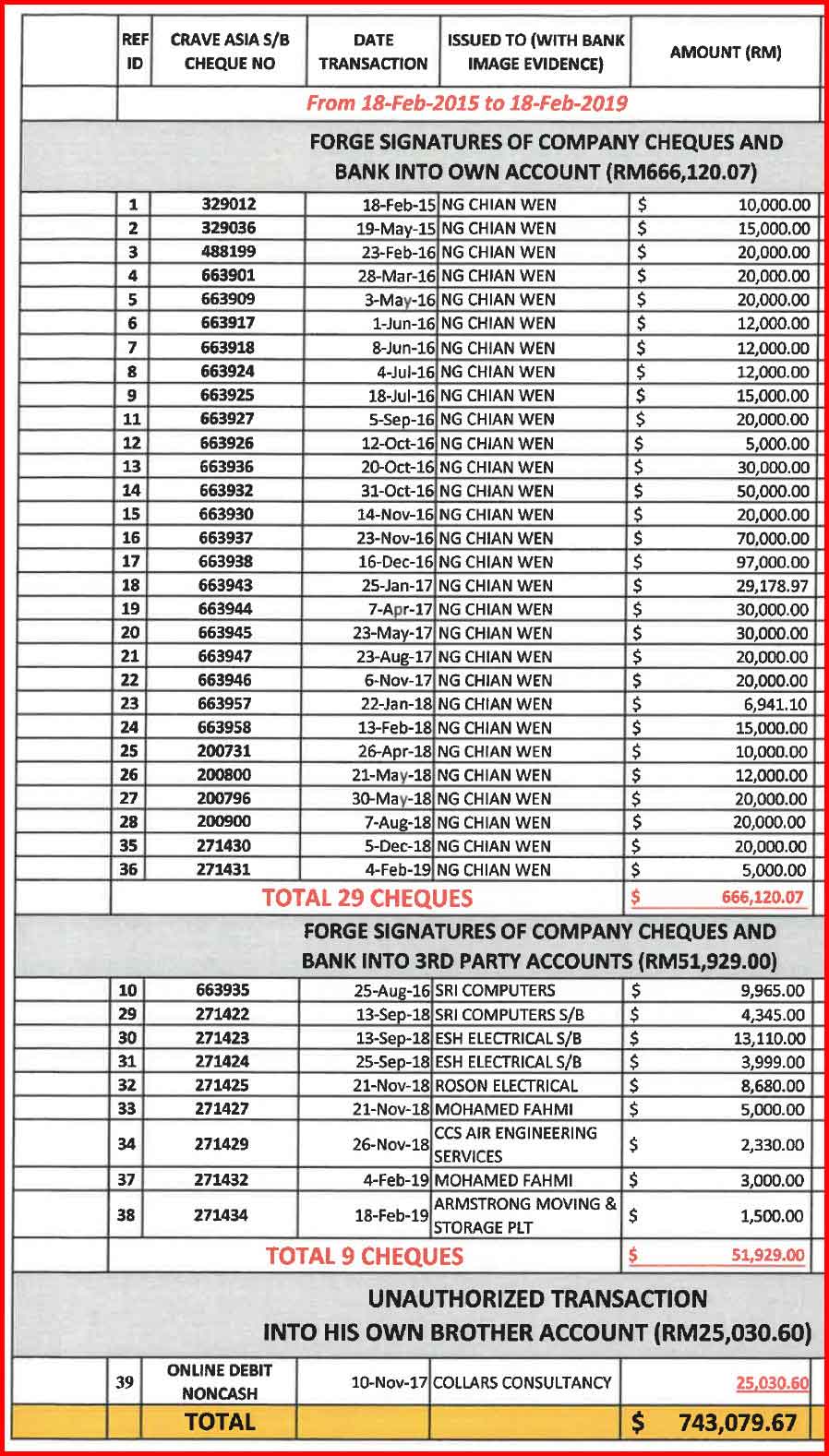

Forged My Signatures to Steven's Own Personal Account

RM666,120

Forged Cheques to 3rd Party (Datuk's Staff Salary, Shopping)

RM51,929

Purchase Apartment from Datuk Fong Chin Tuck

RM420,000*1

Left Contractor Debt to Company

RM120,000

On-going Legal Fees since 2020

RM100,000+ and increasing*2

Apartment Maintenance

RM23,081++*2

LHDN Penalties caused

RM554,562*3

2007 - Solo

How the business started.

In 2007, I started the whole journey from a solo freelancer providing creative and technology services. Over time, this evolved into something larger, forming the company in Sdn Bhd.

2010 - Growth

Early Employee Rewards

As part of our growth into a Sdn Bhd company which back then requires 2 or more partners - I rewarded Steven Ng Chian Wen 10% of company shares as part of the earliest employee rewards, without requiring any investment from him. At that time, the company had fewer than 5 people. I focused on production and business development, while Steven handled project administration and finances. As the company capital grows, his shares reduced to 3.9% in later stage.

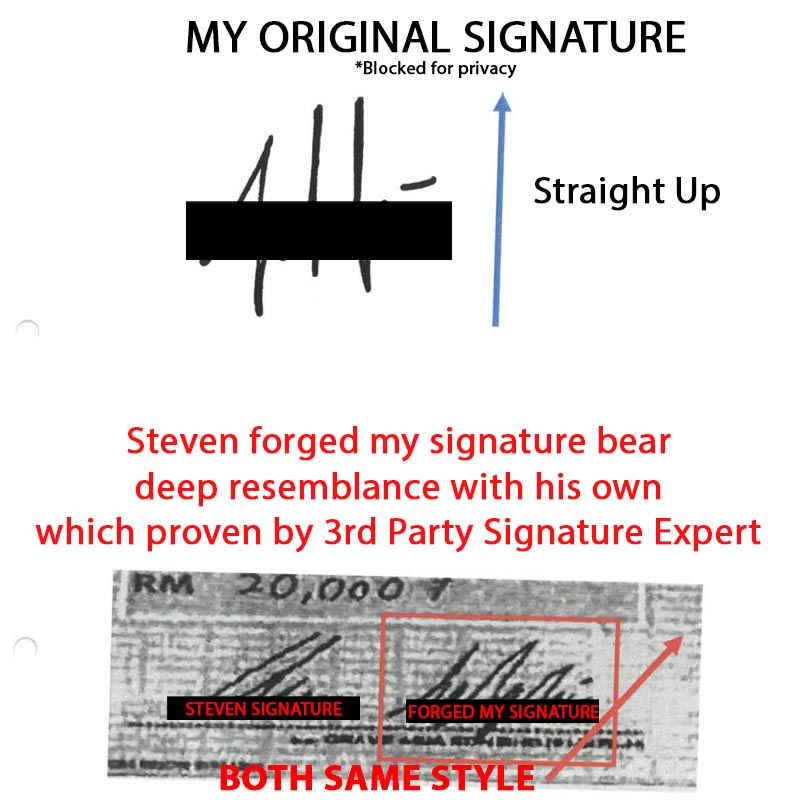

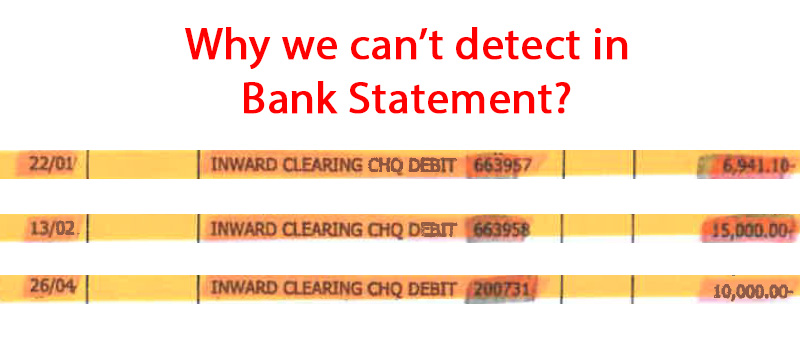

Sample cheques with forged signatures. Many still undetected.

2018 - Datuk

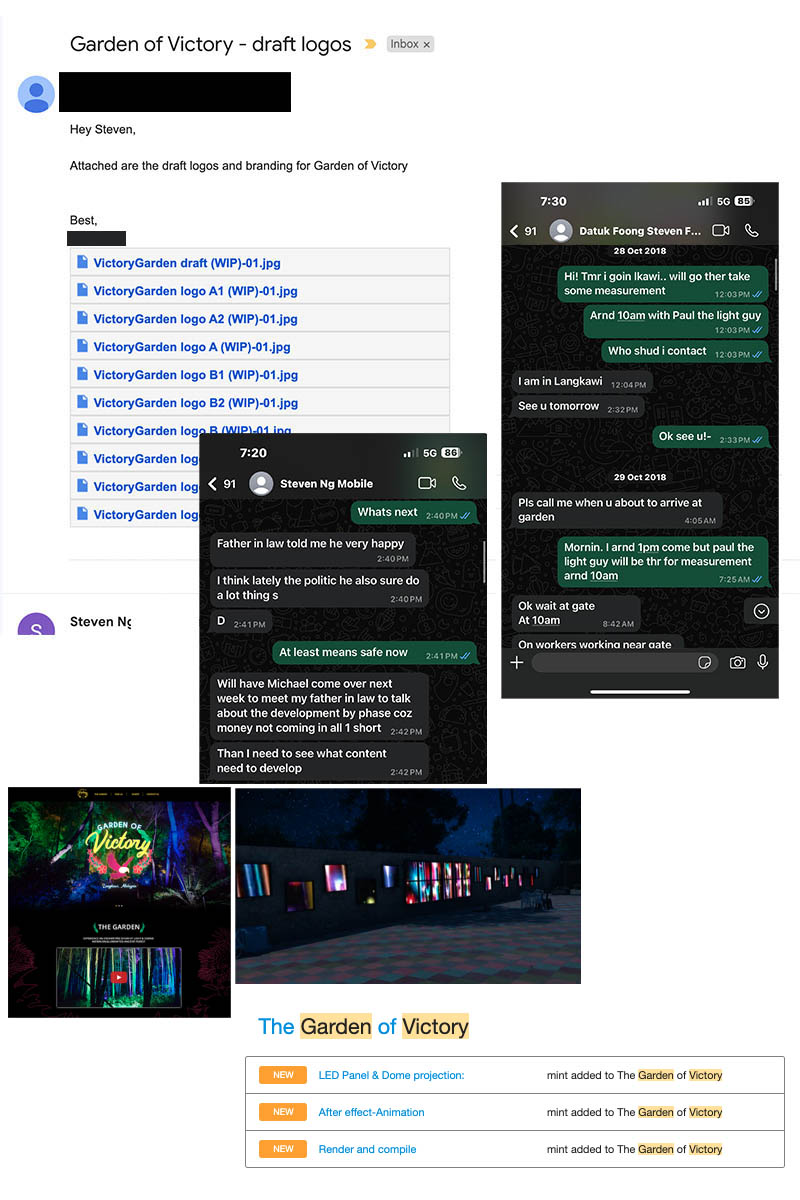

Steven, Datuk & The Langkawi Garden Project

Since beginning, Steven would often brag about bringing “Big Investments or Projects” to the company, yet none ever materialized.

In 2018, Steven brought a RM600,000 project for a multimedia lightshow in "Garden of Victory" Langkawi, owned by his father-in-law and business partner, Datuk Fong Chin Tuck. A RM300,000 downpayment was made, and the project commenced.

Out of the budget, RM350,000 allocated for equipments purchase. RM240,000 allocated for projectors and LED purchases, with a RM120,000 downpayment already made to a local supplier, leaving a debt of RM120,000 to the supplier. The project didn't receive remaining payment despite delivery.

Garden of Victory in Langkawi (Click here to read published in The Star)

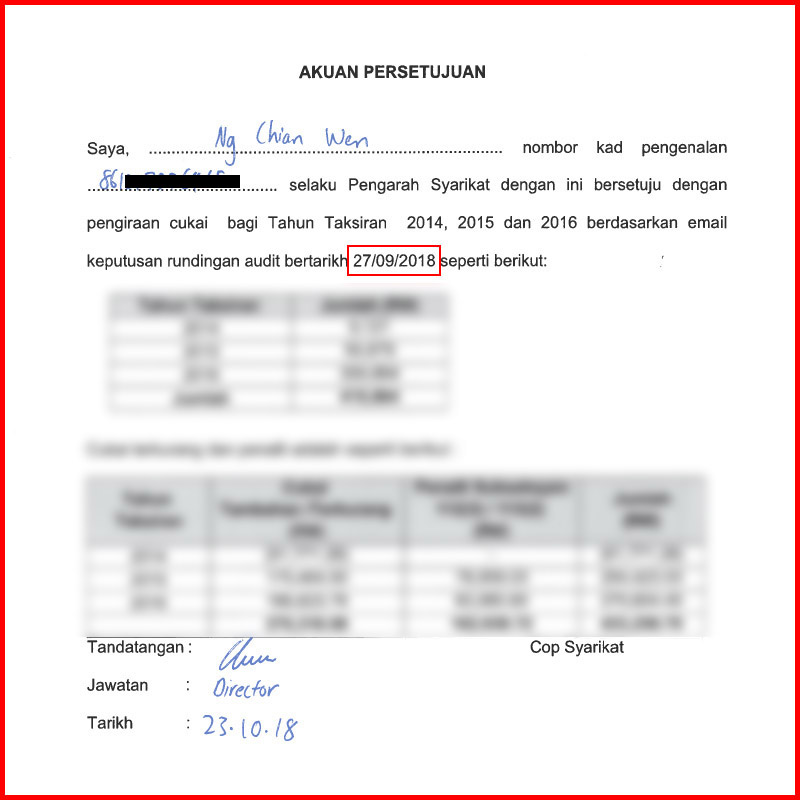

10.2018 - LHDN

Everything seemed rosy on the surface, but the fire was already burning unknowingly.

Due to years of concealed finances, LHDN began raising queries about the "Expenses without bills." I didn't know until they visited to our office which Steven assured me that he would handle it. However, from email records, it became clear that Steven had been evading the LHDN officer for months without informing the company. When the penalty was finally issued, he signed off on it immediately, without hesitation or consultation. This act clearly shows a clear intent to destroy the company before his sudden resignation when the effect fully taken place.

To date, our company has managed to pay a major part of this issue.

Steven immediately signed off LHDN penalties upon issuance without consulting anyone in the company before sudden resignation a few months later upon receiving notice from LHDN which led to Sekatan Jalan next.

07.2019 - Sekatan Jalan

The Beginning of All Issues & Fraudsters Escape Planned All Along.

I was stopped at KLIA while leaving for a holiday by a stoppage order from LHDN. After contacting Steven, who claimed he had no knowledge of the issue (which already resigned in a month before), I reached out to our company auditor. The auditor confirmed that Company just received a notice of unpaid taxes, including penalties, amounting to RM554,562 and mentioned "discrepancies in the company’s bank statements."

Steven's resignation - reason was "Not agree with how I conducted business"

08.2019 - Maybank

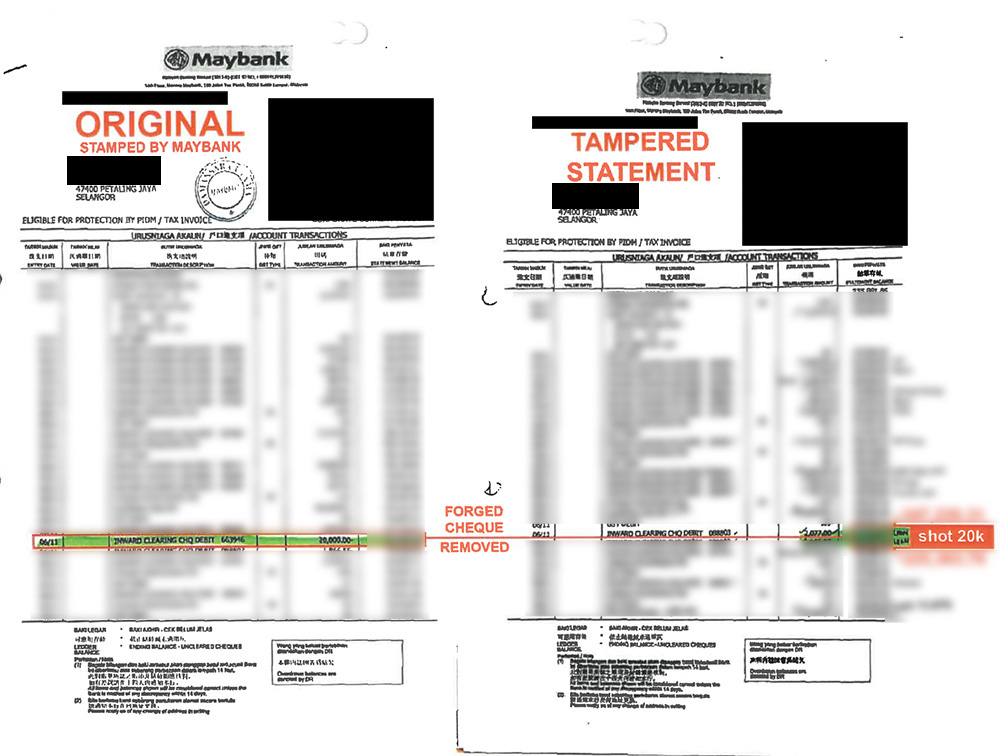

Statement "Errors" = "Photoshopped"

While still in a state of confusion, after noticing financial irregularities, I filed a complaint with Maybank about the statement error. To date, we still never know about all the issues until Maybank officer revealed tampered bank statements hiding a series of cheques with similar running numbers issued to Steven personally over the years. This led to a deeper investigation into other financial dealings.

Steven doctored transactions away from bank statements.

Bank statements only show cheque numbers and amounts - making hard to detect fraud. We never suspected anything, given the volume of transactions for a company every week.

List of 38 cheques "detected". We believe there are more cheques "undetected".

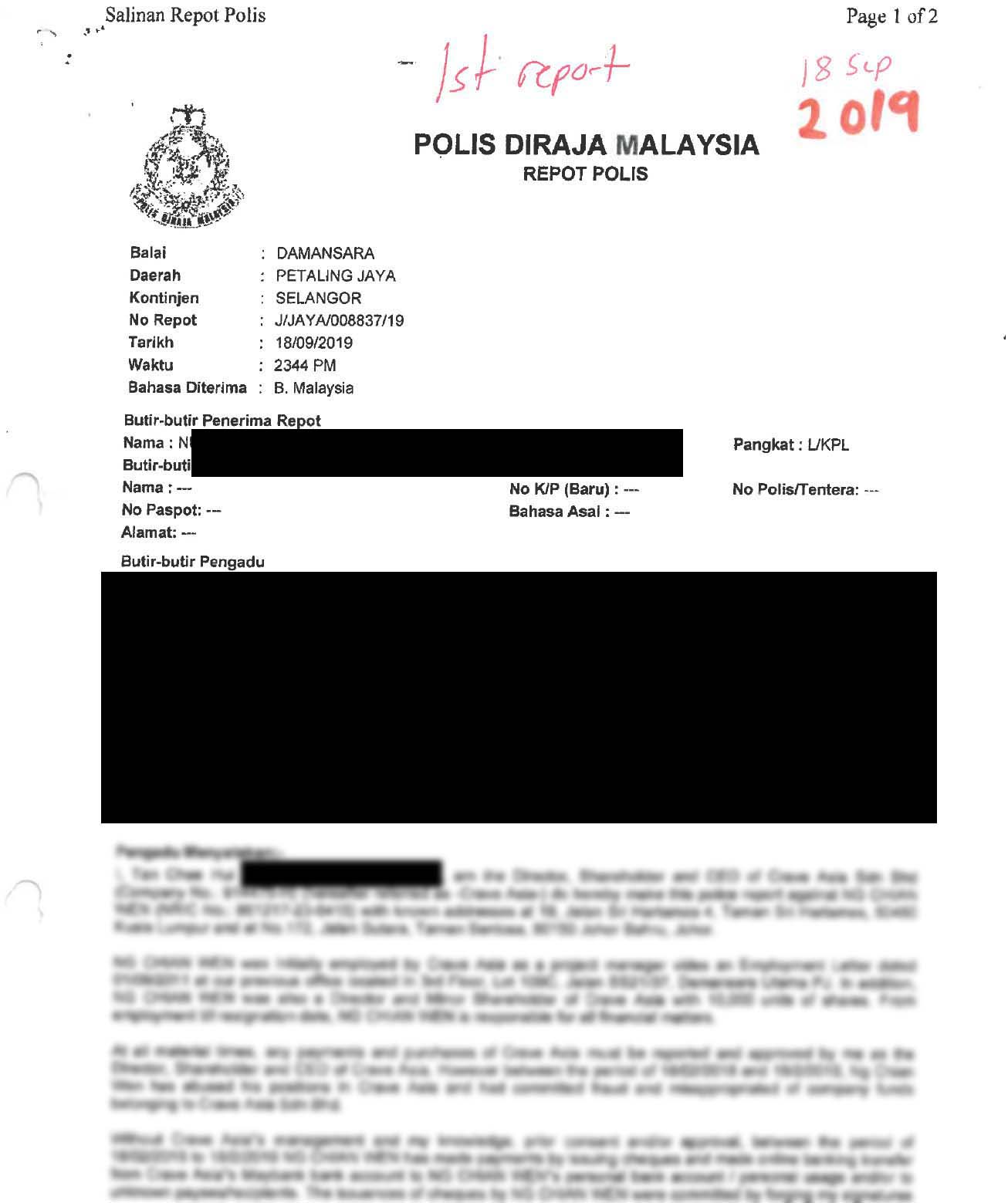

09. 2019 - Polis Report #1

Cheques issued via forged signatures

I lodged a police report at the Damansara Utama police station after found out the forged signatures on cheques and the unauthorized transfer of company funds into Steven’s personal account. However, in later stage - I found out the police report filed as "NFA" or "No Further Action" without any notice to us.

2020 - Apartment

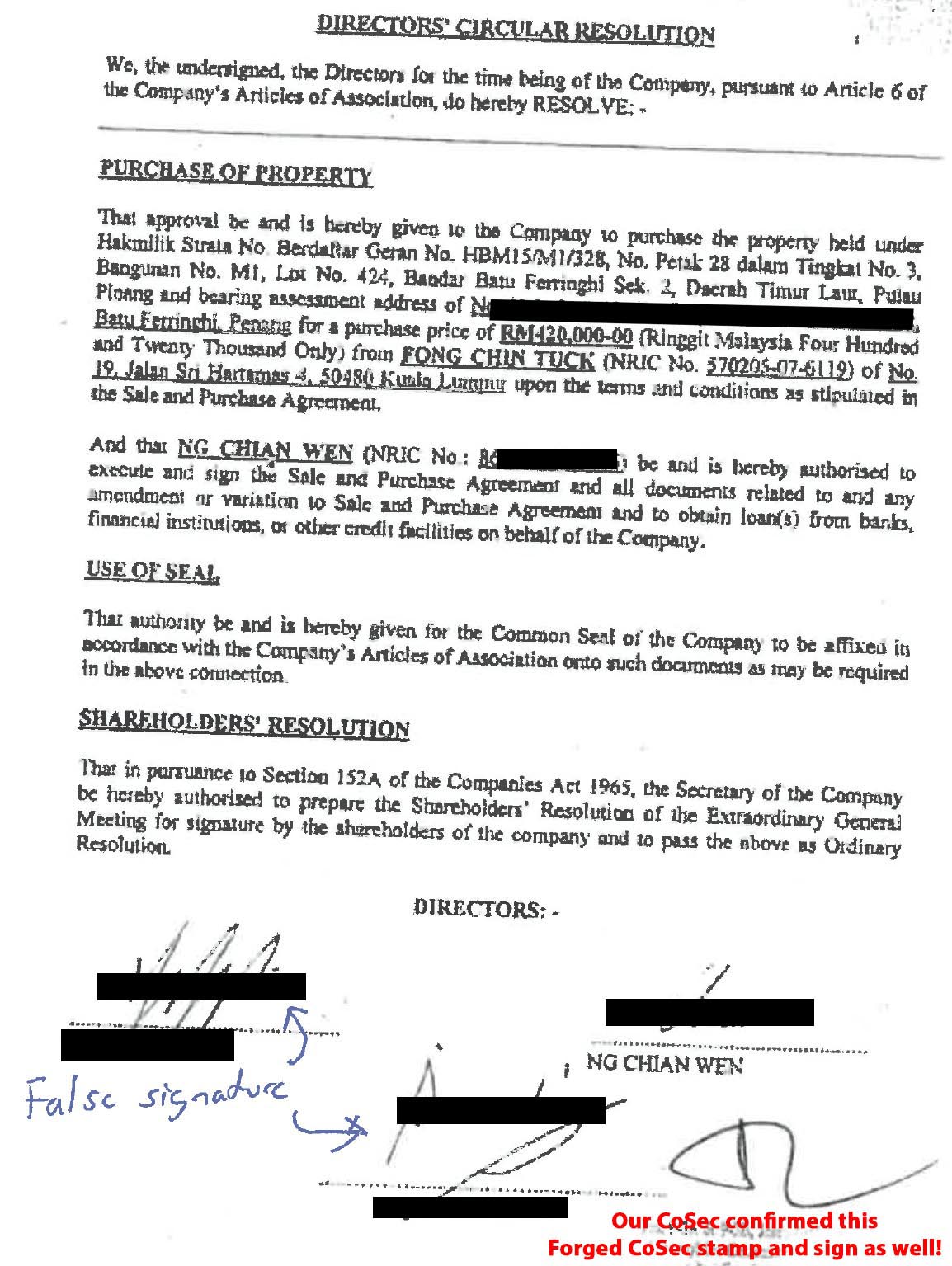

Purchase of Apartment worth RM420,000 via forged signature on Company Letter and Sales and Purchase Agreement.

In early 2020, I was summoned to tribunal court in Penang for unpaid maintenance fees on a property. I assumed it was related to the apartment we rented for the Langkawi project in Langkawi; which later found out an apartment belongs to the company in Penang!

Every asset purchase requires a company letter verified by the company secretary (CoSec). How did Steven pull this off?

Step 1: He requested a letter prepared from CoSec directly, supposedly granting him the power to purchase a property.

Step 2: He proceed to forged all signatures, including mine, another director’s, and even the CoSec’s stamp and signature.

Step 3: He proceeded with their lawyer to finalize the process.

We believe the transfer of this no value property is used as a cover to justify the forged cheques supposedly meant as payment.

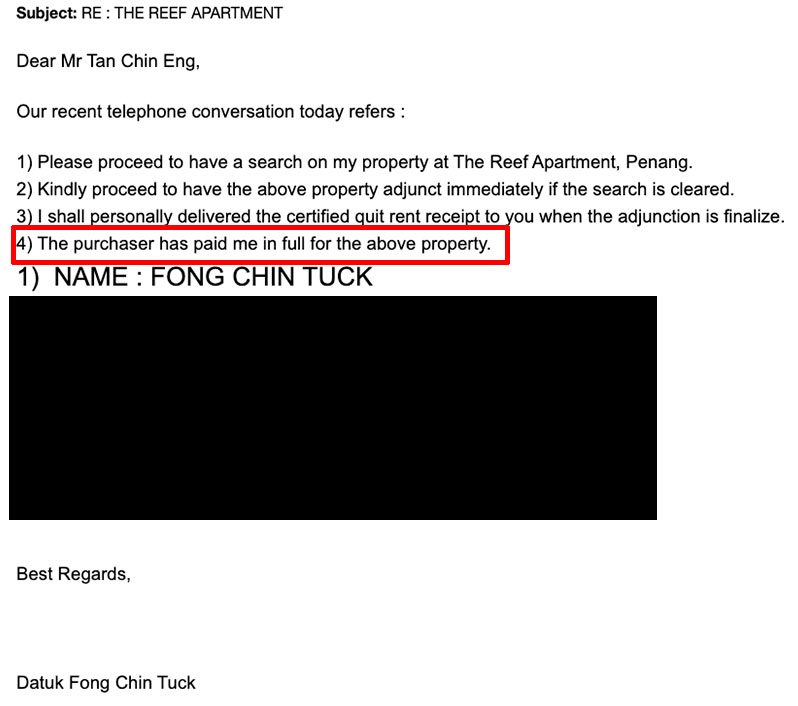

Datuk Fong confirmed the payment paid by our company. We manage to get all email records by accessing into Steven's company email.

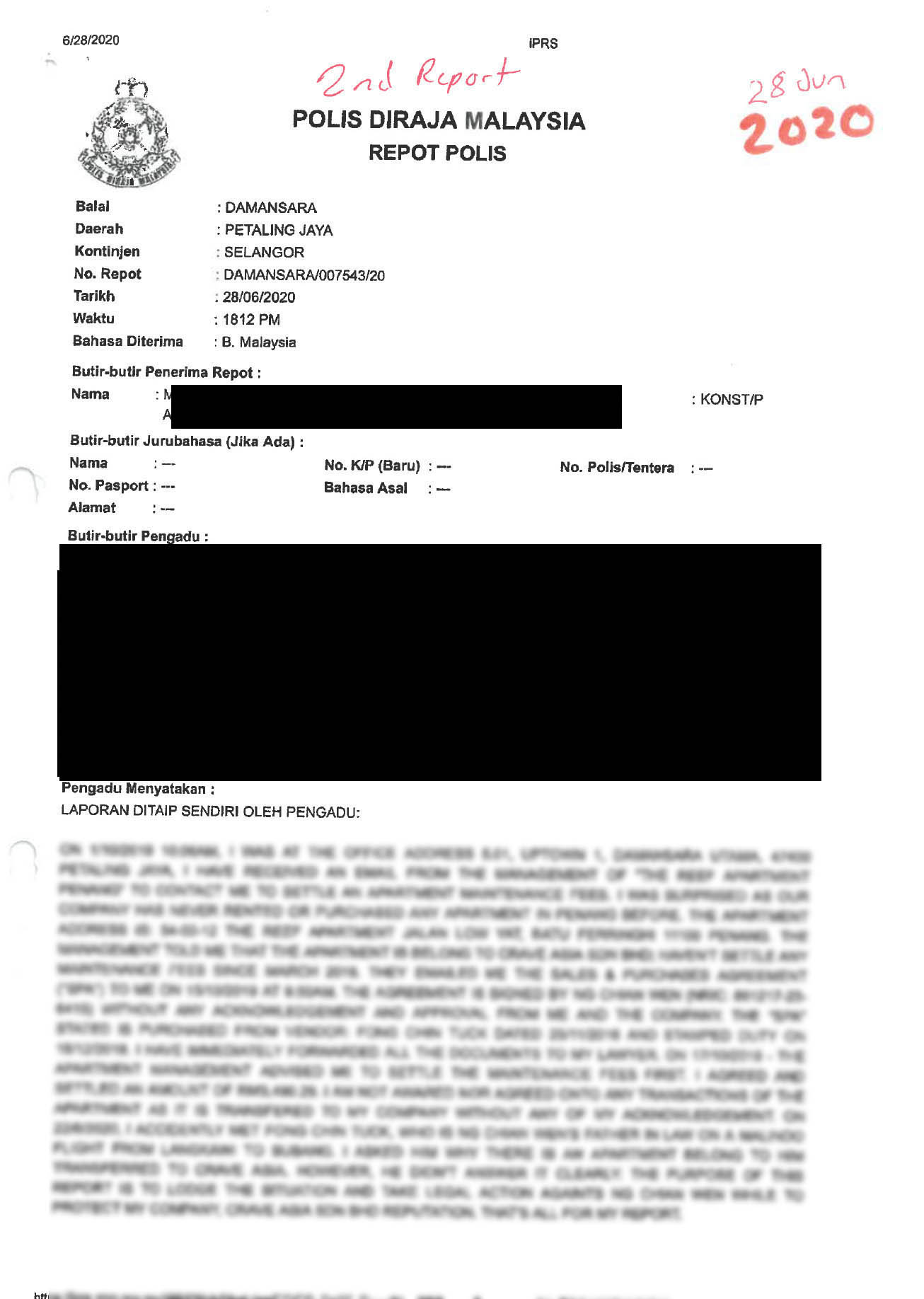

06.2020 - Polis Report #2

A second police report is filed for this apartment purchase.

I filed a second police report, focusing on the illegal purchase of the Penang Apartment and the forged documents used to facilitate the transaction. The case was added to the ongoing investigation. No action taken till date despite severity to forge agreement and company's secretary official stamping.

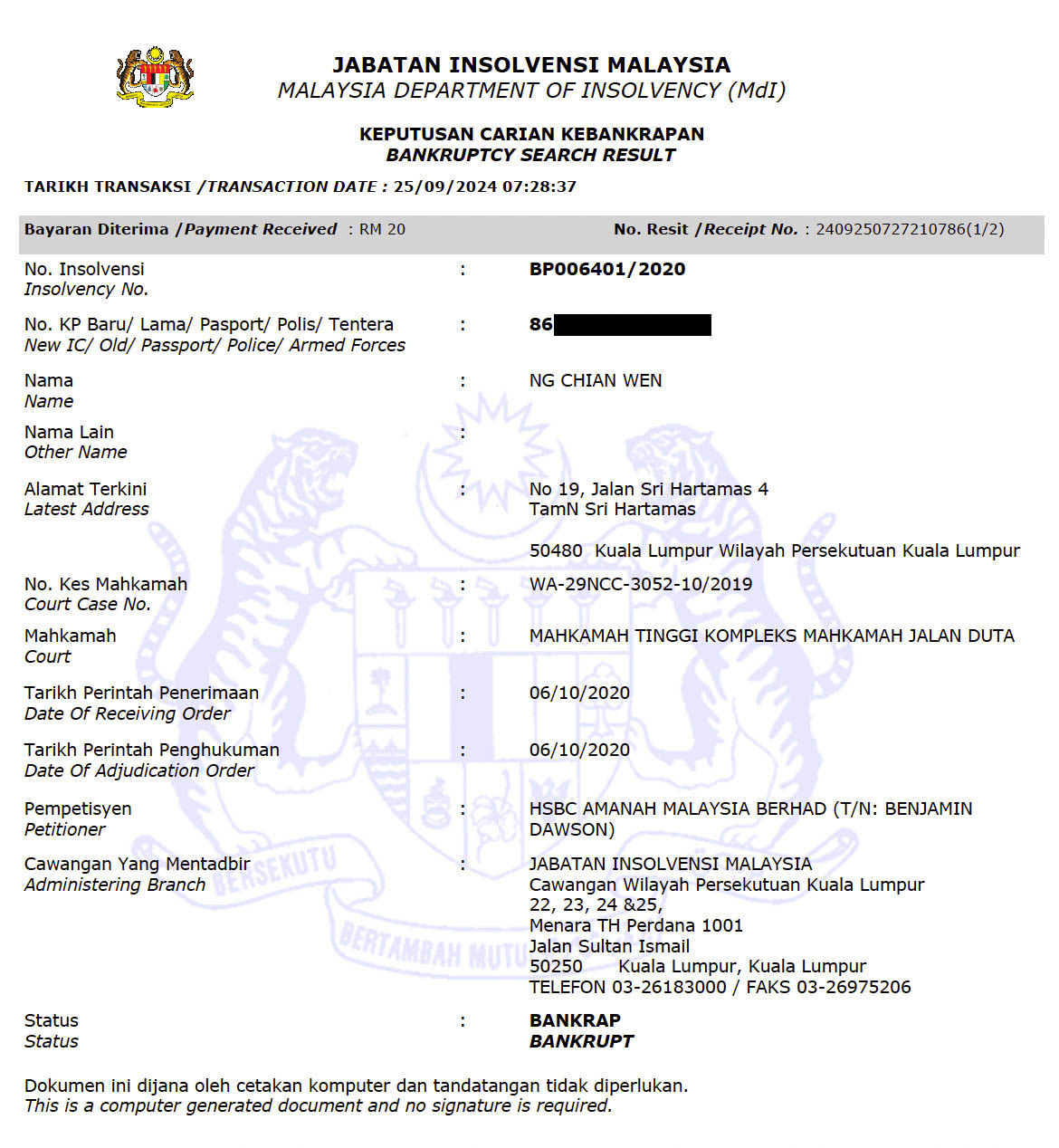

10.2020 - Bankrupt

Steven declared bankruptcy before the court case, complicating matters.

The company filed a writ and statement of claims against Steven in civil court, only to find out he had declared bankruptcy a month earlier, complicating recovery efforts. Legal proceedings continued, but recovering the money from a bankrupt individual is unlikely. Fun Fact: Many people keep telling me that since Steven is already bankrupt, I won’t get any money back — so why bother pursuing it?

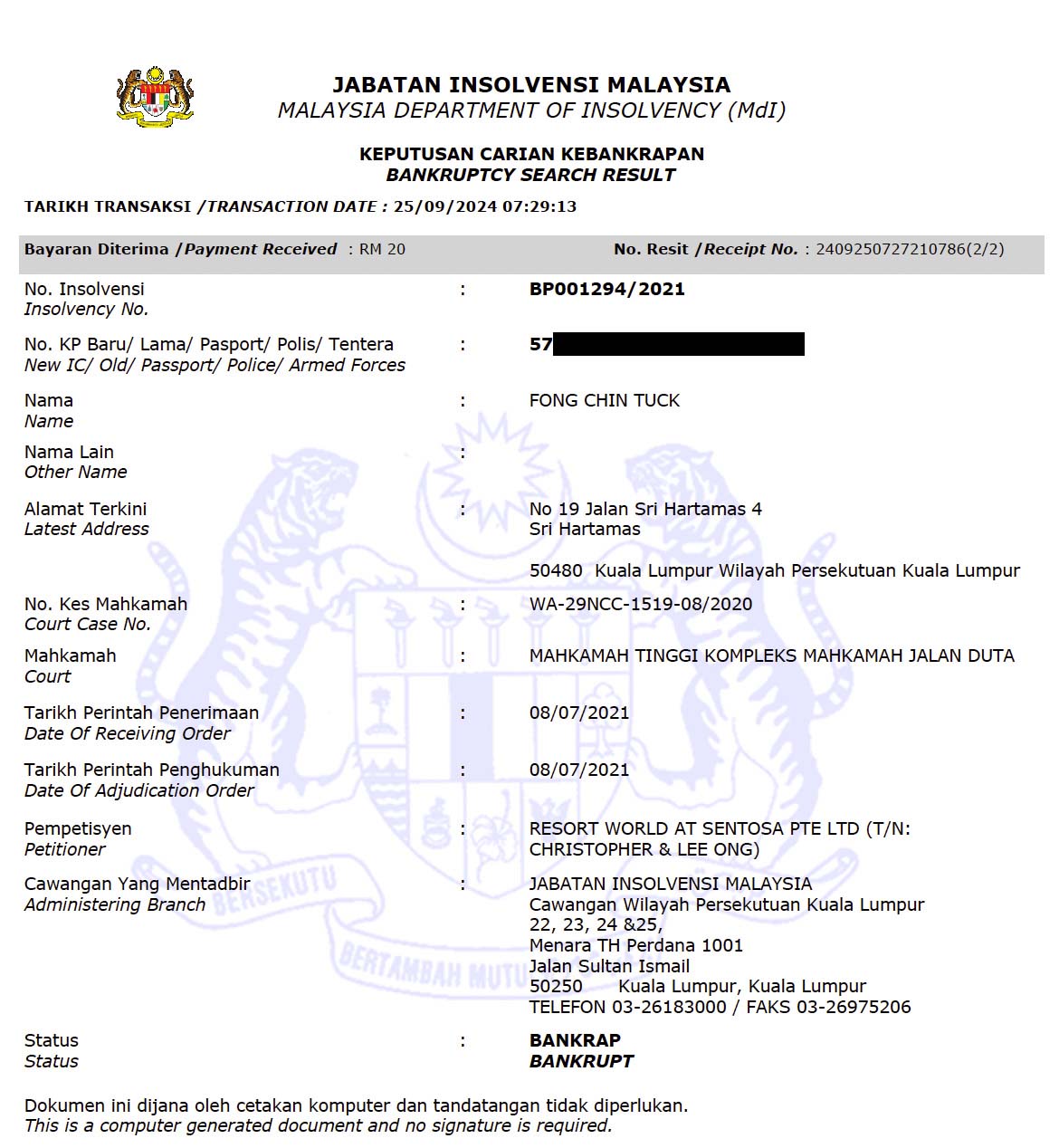

04.2021 - Defense Tactics

Delay Court Case + Datuk Bankrupt

Steven continues to delay the court case with various excuses under the pretext of "filing his defense."

Meanwhile, Datuk Fong Chin Tuck also declared bankruptcy, further complicating the case. It seems clear to me that being bankrupt can run away from many things.

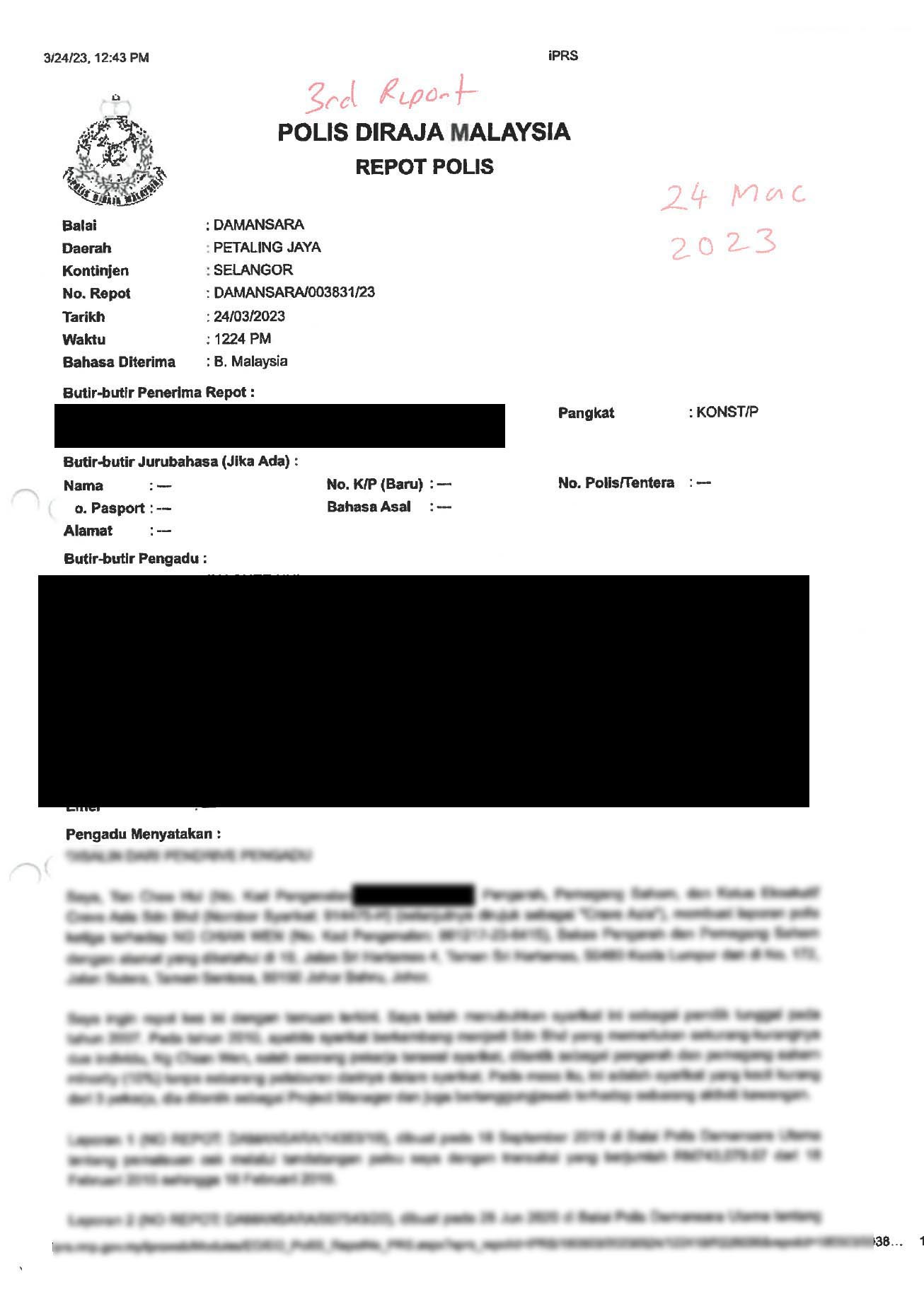

03.2023 - Polis Report #3

1st in 2019, 2nd in 2020 and 3rd in 2023.

Coronavirus pandemic finally past, and it’s been almost three years since the first police report, now I filed a third one.

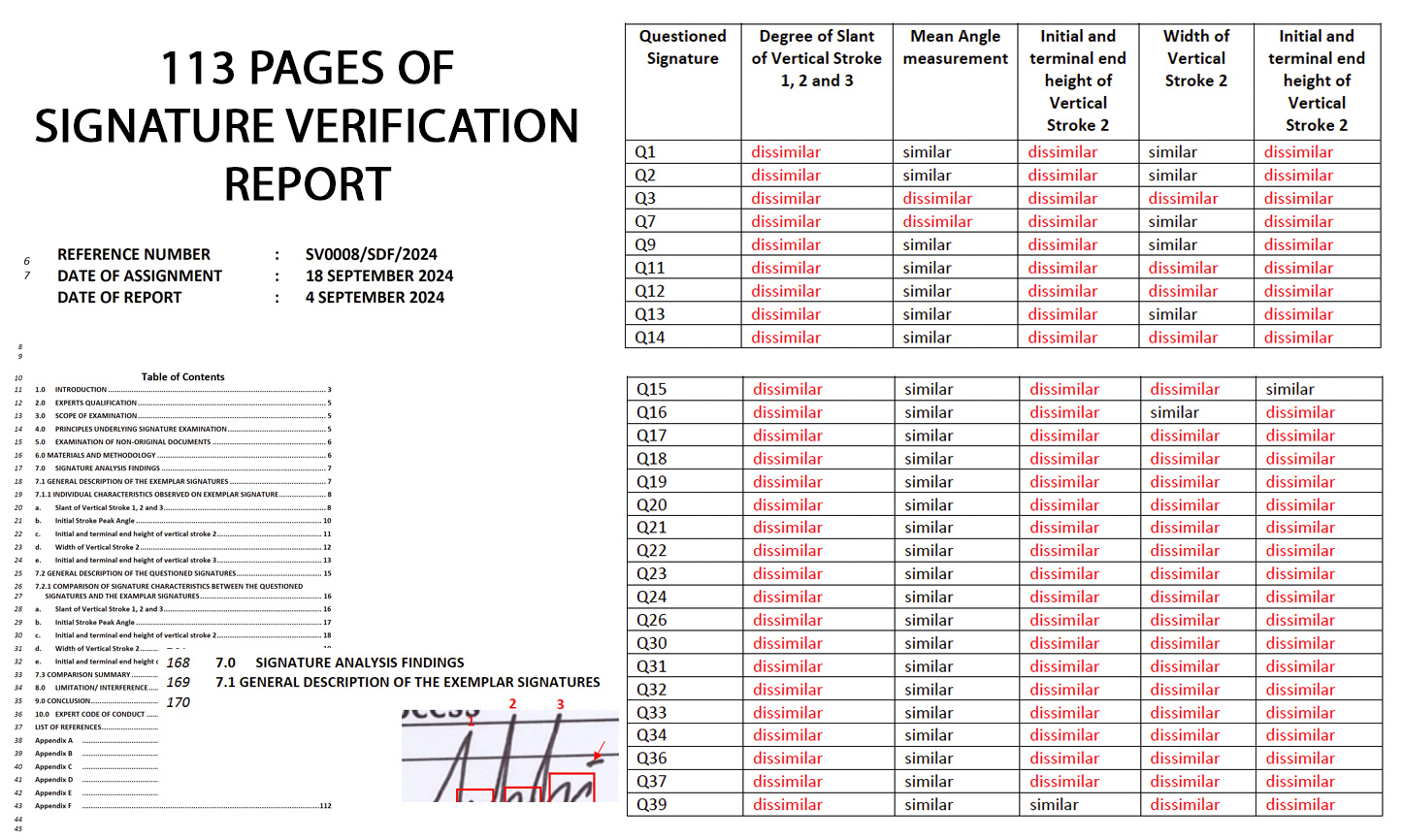

2024 - Forgery Proven

A third-party signature expert verified forgery in key documents.

A third-party signature expert was brought in to verify the authenticity of the signatures on the cheques and documents in question. The expert confirmed that most of the signatures are not mine! However, some were not able to be proven as we lacked “Original Documents of Cheques signed” and only based on “Cheque Images provided by the Bank.” Nonetheless, the clear visible differences indicated a clear pattern of forgery in these cheques and documents to purchase apartment.

My Final Thoughts

It Nearly Costs Our Future

This wrong trust didn’t just damage me—it impacted my entire team. Even now, they continue to clean up the mess—following up with banks, cross-checking accounts, and handling heavy documentation. The good news? We’ve resolved all the issues and implemented strong SOPs to prevent this from happening again.

The lesson is clear: Trust can have wide-reaching effects, impacting everyone involved. When your company grows, people reveal their true selves. While the legal system is there to protect, it can be slow and exhausting. Don’t assume safety—act early before things spiral out of control.

This ordeal nearly cost us everything. Gathering evidence was time-consuming and draining. Even with clear proof, those responsible continuously counterclaim, prolonging the process with every excuse. It’s eye-opening to see how fraudster in Malaysia can walk free, using the system to delay justice while they preying on to their next victims.

The lesson is clear: Trust can have wide-reaching effects, impacting everyone involved. When your company grows, people reveal their true selves. While the legal system is there to protect, it can be slow and exhausting. Don’t assume safety—act early before things spiral out of control.

Thank you for your time.

Disclaimers & Frequently Asked Questions

How long did it take to uncover the full extent of the fraud?

Over 2-3 years, and we believe there are more cheques undetected.

Why didn’t you notice the irregularities earlier?

That's a red flag I learnt is those harsh words with "Don't you believe me?!?!".

What legal actions have been taken against Steven and Datuk Fong?

We only filed civil court and criminal will be waiting to be taken by the Polis.

Why didn’t the auditors detect the irregularities earlier?

They detected and questioned Steven as he been the sole contact, but he answered as "Project expenses" or "Reported and no reply from Maybank".

Did the company recover any of the siphoned funds?

No. Highly unlikely as both is bankruptcy.

Are you the owner of the illegal transferred apartment?

Some have said, "At least you gained something," but the reality is we’re trapped. We can’t sell the apartment due to its legal status, and we're still burdened with ongoing maintenance fees.

How did the partnership with Steven start?

I rewarded him with shares as one of our early employee.

How has the company managed to grow despite these challenges?

Thankfully the clients that working with us, been with us all these while.

Why share now, not after the court case?

The civil court case shows no sign of ending soon, and while I must respect the legal process, I believe it’s important to share what I can now to raise awareness and help others avoid similar traps.

What would have happened if this ordeal had bankrupted your company?

If this had bankrupted the company, I would have been consumed by the financial crisis and distracted from investigating the fraud. I might not have uncovered the full extent of the wrongdoing, and they could have walked away freely. It feels clear to me that this was their ultimate intention—create chaos, cripple the company, and escape without accountability.

Disclaimer: The legal process and challenges described here reflect my personal experience. While trust played a damaging role in my case, I have also seen many partnerships thrive and prosper based on foundation of trust.

Hereby, I would like to sincerely thank you my family, team, friends and goverment officers who shows truly great patience throughout this ordeal! I feel so much better after sharing this out. Thank you!